- #FREE DOWNLOAD PAY STUB GENERATOR#

- #FREE DOWNLOAD PAY STUB MANUAL#

- #FREE DOWNLOAD PAY STUB FREE#

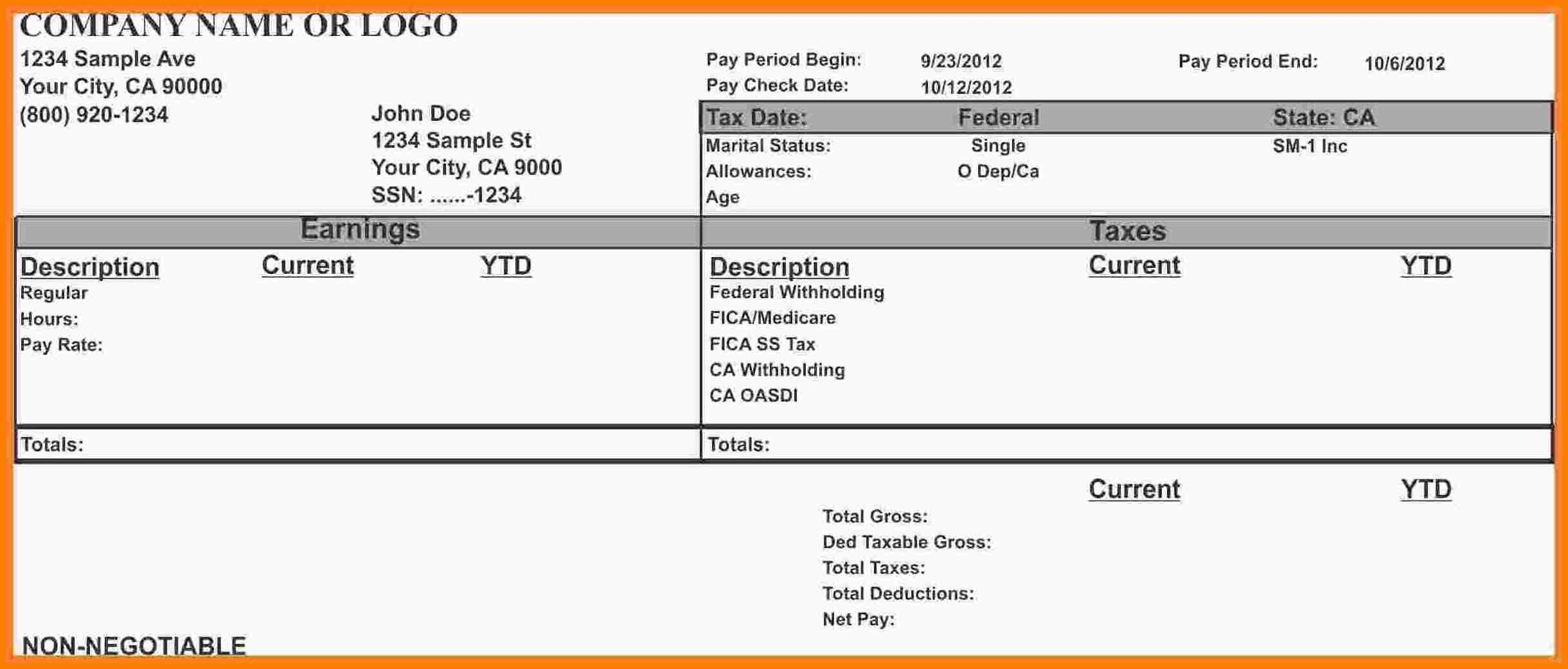

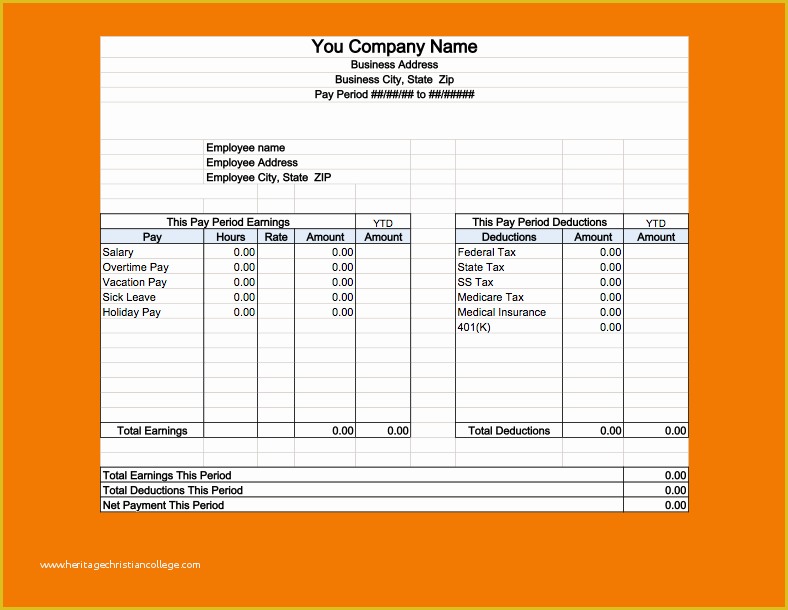

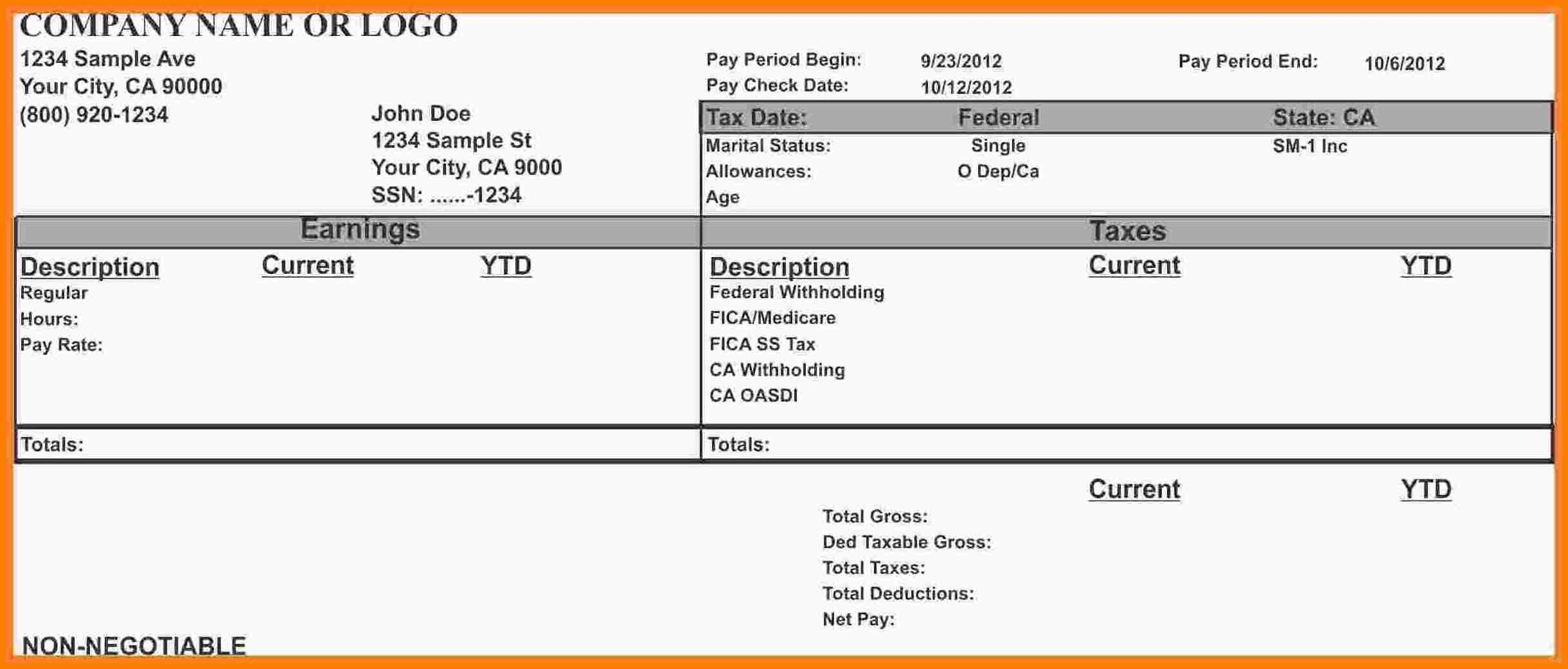

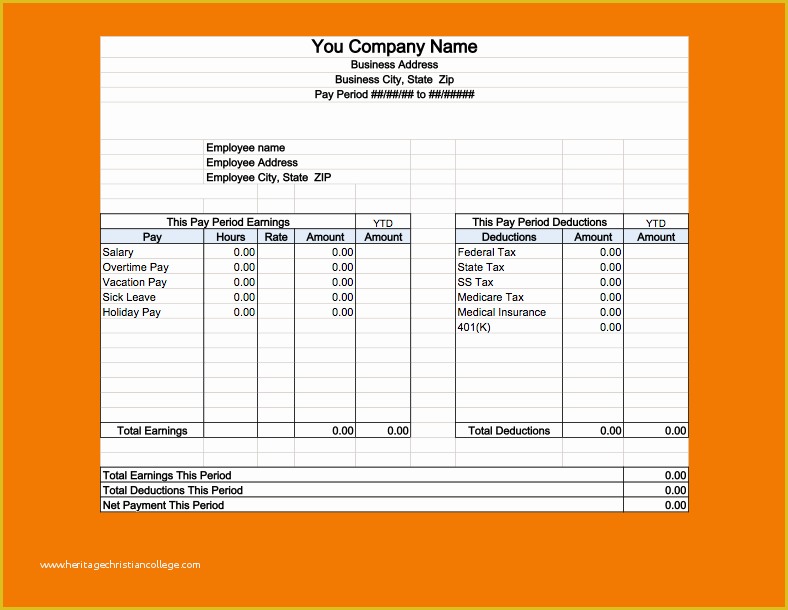

Some of those also mandate in what form employees must receive them. There are currently 41 states that require employers to provide pay stubs to their employees. Regardless, providing a pay stub is a good practice because it ensures you have solid backup information in the event of an audit. However, some states-like Arkansas and South Dakota-don’t require employers to provide pay stubs to employees at all. State law typically dictates the information you should include on a pay stub, although generally it will include basic employer and employee information, pay period and rate, gross earnings, taxes, and net pay, among other data. Any words or rows you don’t use can be left blank, customized, or deleted from the template to make this work for your business. It contains all of the basic information fields you may want to document earnings and deductions.

#FREE DOWNLOAD PAY STUB FREE#

Here is a general downloadable free pay stub template in which you can input your data and then save or print. Visit Gusto General & Industry-specific Pay Stub Templates In addition to offering pay stubs, it allows your employees to manage their account information online or via a mobile device and print their payroll documents.

#FREE DOWNLOAD PAY STUB MANUAL#

This article provides a variety of free pay stub templates to help you comply with laws in the 41 states that require employers to provide them-even if paying with cash or direct deposit.Īs your small business grows and you want to spend less time creating manual pay stubs altogether, consider using a payroll service like Gusto.

#FREE DOWNLOAD PAY STUB GENERATOR#

fill out the tax information accordingly on the 1099misc generator and follow the next step.A pay stub is a document that serves as a record of an employee’s paid wages in addition to taxes and deductions withheld.

All you have to do is make sure you know your earned income. Forms 1099misc are to be used if you pay an independent contractor more than $600 in a year. Our information form 1099 is easy and fast. Either way, you have to keep track of your estimated taxes, business expenses, and pay the internal revenue service before the filing deadline of April 15th every year. Some people pay quarterly taxes to make it easier on themselves. When you’re self-employed, you might keep track of your taxes in a data entry spreadsheet to make things easier. It might be scary if you’ve never filed forms before, but income tax is a part of life. We understand that nobody likes to file taxes and dealing with an IRS form can feel dreadful when you’re not ready for it. You can even open up your mobile app browser and fill it out on your phone. Also, great for any freelancer that needs to create forms 1099misc for themself. Our online 1099misc form generator is perfect for any trade or business owner overseeing a large or small business. If you’re looking to generate forms such as tax forms, check out our form w2 creator, or a 1099misc creator. If you have any questions, check out our frequently asked questions page. You can then print your pay stub instantly directly from your email. Once you’re done, the pay stub form will perform an auto calculation and your net pay will appear at the bottom. First, fill out your company name, hourly rates, total hours, pay period, pay date, and other required pay stub information into the stub calculator. Whether you’re applying for a credit card or a home loan, you’ll need to show proof of income, and paystub makers like ours can help.

Paystubsnow is the best pay stub generator and we make it easy to generate paystubs. Our online check stub maker makes it easy for employees or independent contractors to print their paystubs online. Perfect for small businesses or freelancers looking to have reliable pay stub generating options. A paystub maker is a convenient way to make paycheck stubs online using our pay stub generator tools.

0 kommentar(er)

0 kommentar(er)